|

| Roger Sherman, United States Senator from Connecticut (1791-93) |

Our political system is still the most brilliant one ever designed, so just complain, participate in it!

Thomas Jefferson and other early American political leaders who endorsed Republicanism for the newly created United States believed that the best kind of world to live in was one in which political sovereignty rested with the citizens and not with autocrats or aristocracies.

For representative government to really work, it was thought that civic virtue should first be cultivated widely so that passion for the public good would tend to prevail over narrow, personal and commercial interests. The people’s elected representatives in the legislative branch could then draw on this virtue and look out for the best interests of both majority and minority groups when they wrote the laws necessary for the administration of good government. This civic virtue of citizens was very much about citizens being politically informed, aware, and engaged with their government.

The franchise was very limited in our country’s early years, and of course only relatively few could vote. It would certainly be reasonable to assume that America’s early leaders didn’t even take into account the will of more than just a fraction of the constituents they were elected to represent. But most citizens today can vote in elections if they choose to, and thanks to constantly evolving technologies, they have never had more ways to communicate their positions to whom they elect to represent them in the U.S. Congress.

I suspect that one reason behind why things haven’t been working so well in Washington is that too little of the American electorate is really engaged in our country’s political life. By this I mean voters actively debating political positions among themselves and then expressing their views and positions to their elected representatives on a regular basis. A mid-2010 Washington Post-ABC news poll confirmed growing voter apathy towards the job Congress is doing. This poll also confirmed that only 29% of voters were inclined to re-elect their representative in November 2010. Apparently, voter sentiment hasn’t been so low since the big political re-alignments of 1994 and 2006, when opposition parties swept to power.

Despite the heated, polemic exchanges at town hall meetings that you can watch by the dozen on YouTube, you have to ask if members of congress are really getting a representative sample of all the material viewpoints of their constituents. To me, it seems entirely possible that voters can indeed get the political outcomes they desire that are proportionate to their degree of civic engagement if they collectively persevere in expressing their views.

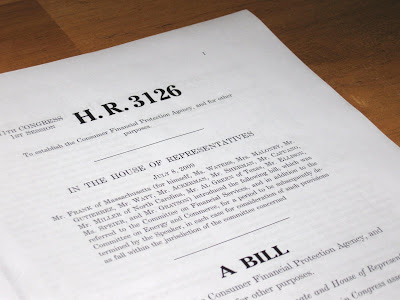

When was the last time you picked up the phone, wrote a letter, or sent an e-mail to express your views to your representatives in congress? As a proponent of strong financial regulatory reform, I’ve been doing it a lot myself lately and really encourage others to share their viewpoints.

I should ask around more about it, but I often find that, while my friends may be bothered by a particular problem within the public realm, they still don’t express their views on it to their representatives who really the ones in the position to effect change. This inaction is unfortunate, because while the volume of messages from constituents may prohibit members of congress from providing much personal attention to each one, the total number of constituents expressing a particular position certainly does matter to how that member will vote.

So I encourage you to organize your thoughts and then speak up about the problems and possibilities in the public realm that are important to you through letters, e-mail, phone calls, personal office visits to your Representative or Senators. Consider using social media tools to regularly share information and express your views, write and give speeches, consider participating in interviews by podcast. Consider contributing to your own blog regularly then turning the content into a book later.

I’m not sure if civics is taught in schools anymore, but each generation of Americans will need to learn for itself what our country’s founders clearly understood: that active civic participation does matter and that the regular exchange of views is required to achieve political outcomes that are more satisfactory to us all.