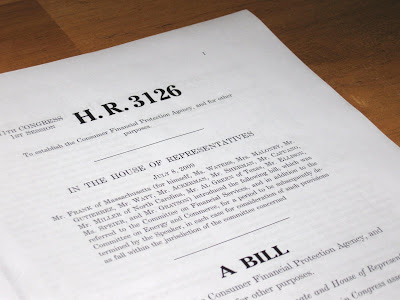

The House bill to create a Consumer Financial Protection Agency

The House bill to create a Consumer Financial Protection AgencyWe’re now 18 months out from the near financial meltdown of September 2008 and 27 months out from when the economy began to enter a downturn in December 2007. Households throughout the country have been forced through unemployment, underemployment, or reduced household wealth to make tough choices about spending and managing large debt levels. In these difficult economic times, in my view, good personal financial management needs to be more widely practiced and refined to the level of an art. If nothing else happens from doing so, good spending and saving habits re-enforced by financial literacy and good management skills, could be in place more broadly at the start of the next age of prosperity.

Although some of us are good at handling our money and saving for the future, many people are not. We all benefit as a country, however, when most households do a better job at it. Perhaps the most important financial objective for households in the long-run is to build up their wealth (that is, their net worth--assets, such as home equity, minus liabilities, such as mortgage debt). I’m certain that widespread financial literacy would help get them there.

The Federal Reserve announced last week that household net worth continued to slowly increase to $54 trillion at the end of last year, following a plunge to $48 trillion in early 2009. It had peaked at $65 trillion in 2007. It’s interesting to note that a large chunk of this increase in household net worth came from a drop in household debt, as an increasing number of financially stretched consumers defaulted on mortgage and credit-card debts. It would have been better of course if these consumers were able to get rid of this debt by paying it back instead. The bad employment situation being what it is, greater financial literacy would have helped better position households to do just that.

When looking at the impact of financial literacy on individuals consider this. In 2007, the Center for Retirement Research at Boston College conducted at survey which found the value of a typical 401K retirement account for a worker approaching retirement was just $78,000. During the financial crisis that followed a year later, retirement accounts more weighted in stocks then lost 30% of their value, although they rebounded a bit later. But perhaps good financial literacy could have led to more saving by many workers earlier in life and more comfortable retirements later on.

I’ve had some trouble finding a definition of financial literacy that I’m completely satisfied with but one that I will go with here is: the ability to read, analyze, manage, and communicate about the personal financial conditions that affect material well-being. It includes the ability to discern financial choices, discuss financial issues without discomfort, plan for the future and respond competently to life events that affect everyday financial decisions.

Do we dare ask ourselves--just how financially literate are we? For example, how many of us:

- know our exact bank balance from manually balancing our checkbook?

- prepare personal balance sheets on a regular basis so that we know exactly what we own relative to what owe?

- prepare a budget at least annually, so that we may meet long-run financial goals, and track our spending against it?

- take the time to really understand the risks with our investments?

I consider financial literacy and the ability to make good decisions from it, a core life skill--like understanding and practicing good nutrition, but it’s skill that even some of the best educated in our country can neglect.

Financial illiteracy (and aliteracy) is sub-optimal, un-necessary, and can be addressed provided that there is a societal and personal commitment to reverse it. I believe that regular reading on topics like budgeting, taxes, investing, retirement planning, and the economy throughout our lives can by itself go a long way towards building and maintaining our financial literacy. But there are also many educational resources available for those motivated to learn--some of the most useful exist online, are interactive, and improve in quality all the time.

High school and community college courses on personal financial management have grown increasingly common. Although personal financial management has been traditionally thought of as a remedial topic of study, and as such has been absent from baccalaureate degree curriculums, perhaps now’s time to reconsider including it.

Even the federal government has become more involved with promoting it. In 2003, Congress created The Financial Literacy and Education Commission with the mandate “to improve financial literacy and education of persons in the United States.”

With a slowly growing economy, unemployment is now expected to remain high for years. Our national debt is expected to approach 100% of GDP by 2012 so income taxes for individuals are certain to increase even if government spending grows more slowly. Financial resources are seriously inadequate for an aging population. But, as a first line of defense, financial literacy and good financial management habits that begin early and remain robust throughout life will certainly improve upon these circumstances.

No comments:

Post a Comment