I've had a dream or two in which the United States economy reached a level of full employment (95% of the workforce or above employed) and stayed there. Also in these dreams was an economy in which workers would tend to keep their jobs if they did them to the best of their ability and they committed themselves to regular updating of their skills over time.

I sometimes wonder what it must of been like to have been in the labor force between the years of 1948 and 1968 when stable employment in our country helped an American middle class ride an escalator into steadily improving standards of living. Sadly, some missed out on this ride, but most did not.

Then something went wrong with stable employment during the 1970's, and then something went very wrong with the hopes of many for stability in employment beginning after the 1980 Presidential election. Some might say that the decline of labor unions, the collapse of the Berlin Wall, and NAFTA strongly accelerated the trend. But don't also forget the business fad of "re-engineering" popularized by Michael Hammer in his 1993 book Re-engineering the Corporation , offshoring, and the productivity pay-off to employers who could now easily substitute information technology for labor after many years of investment.

Economists are still telling us today with a straight face that that raising productivity will lead to higher living standards over time. But this certainly isn't what happened at all after the 2000 Presidential election when productivity surged while real incomes of four-fifths of American households went nowhere. By this time, our euphemistically named "flexible" economy really began to rest on what had become to a large extent, a lay-off culture.

Unit labor cost is defined as the ratio of hourly compensation to labor

productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them. Increases in productivity is supposed to reduce employer's unit labor cost allowing for higher wages.

Unit labor costs in non farm businesses fell 5.9% in the fourth quarter of 2009, the result of productivity increasing faster than hourly compensation. Unit labor costs decreased 4.7% from the same quarter a year earlier, the largest four-quarter decline since this started being tracked in 1948. And where did incomes go? Where you might expect--nowhere!

Allen Sinai of the economics research firm Decision Economics stated it pretty directly when he was quoted as saying in a February 11, 2010 New York Times article: "American business is about maximizing shareholder value. You basically don't want workers. You hire less, and you try to find capital equipment to replace them."

Microeconomic theory may consider labor as purely one of the substitutable inputs that go into production, but of course, labor is more than just that because wages exchanged for it are central to human well being. I try to be careful about making predictions, but clearly labor dislocation has gotten so out of hand during a Great Recession that followed a lay-off culture lasting more than a generation, that the future will be bright for employers who become well known for not laying off workers and finding other ways to reduce their fixed costs. The value of this good reputation in the future markeplace for America's "talent" will be built right into the employer's brand equity and be measurable.

The MetLife Foundation and San Francisco-based Civic Ventures, a think tank focusing on baby boomers, work and social purpose, recently released a report that suggested that the United States will in fact experience a four million worker shortage with in ten years. If this report is in fact correct, than employers have a strong competitive incentive not wait to begin re-hiring workers and to keep their employees happy going forward by rewarding them appropriately and treating them fairly. But to be competitive within this changed environment, employers will also need to build and maintain their reputations for low or no lay-offs.

Three excellent articles on this subject are:

"Slash and Earn", appeared in the March 20-26, 2010 issue of The Economist

http://www.economist.com/business-finance/displaystory.cfm?story_id=15731230.

"Worker shortage coming as population ages: report", MarketWatch, March 22, 2010

http://www.marketwatch.com/story/worker-shortage-coming-as-population-ages-report-2010-03-22

"Median income rose as did poverty in 2007; 2000s have been extremely weak for living standards of most households", EPI, August 26, 2008

http://www.epi.org/publications/entry/webfeatures_econindicators_income_20080826/

Sunday, March 21, 2010

Monday, March 15, 2010

Getting Serious About Financial Literacy

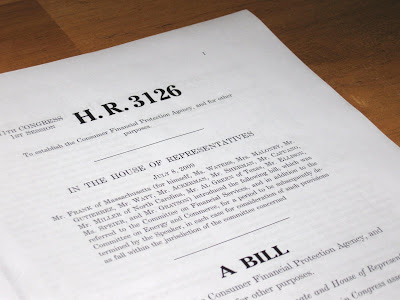

The House bill to create a Consumer Financial Protection Agency

The House bill to create a Consumer Financial Protection AgencyWe’re now 18 months out from the near financial meltdown of September 2008 and 27 months out from when the economy began to enter a downturn in December 2007. Households throughout the country have been forced through unemployment, underemployment, or reduced household wealth to make tough choices about spending and managing large debt levels. In these difficult economic times, in my view, good personal financial management needs to be more widely practiced and refined to the level of an art. If nothing else happens from doing so, good spending and saving habits re-enforced by financial literacy and good management skills, could be in place more broadly at the start of the next age of prosperity.

Although some of us are good at handling our money and saving for the future, many people are not. We all benefit as a country, however, when most households do a better job at it. Perhaps the most important financial objective for households in the long-run is to build up their wealth (that is, their net worth--assets, such as home equity, minus liabilities, such as mortgage debt). I’m certain that widespread financial literacy would help get them there.

The Federal Reserve announced last week that household net worth continued to slowly increase to $54 trillion at the end of last year, following a plunge to $48 trillion in early 2009. It had peaked at $65 trillion in 2007. It’s interesting to note that a large chunk of this increase in household net worth came from a drop in household debt, as an increasing number of financially stretched consumers defaulted on mortgage and credit-card debts. It would have been better of course if these consumers were able to get rid of this debt by paying it back instead. The bad employment situation being what it is, greater financial literacy would have helped better position households to do just that.

When looking at the impact of financial literacy on individuals consider this. In 2007, the Center for Retirement Research at Boston College conducted at survey which found the value of a typical 401K retirement account for a worker approaching retirement was just $78,000. During the financial crisis that followed a year later, retirement accounts more weighted in stocks then lost 30% of their value, although they rebounded a bit later. But perhaps good financial literacy could have led to more saving by many workers earlier in life and more comfortable retirements later on.

I’ve had some trouble finding a definition of financial literacy that I’m completely satisfied with but one that I will go with here is: the ability to read, analyze, manage, and communicate about the personal financial conditions that affect material well-being. It includes the ability to discern financial choices, discuss financial issues without discomfort, plan for the future and respond competently to life events that affect everyday financial decisions.

Do we dare ask ourselves--just how financially literate are we? For example, how many of us:

- know our exact bank balance from manually balancing our checkbook?

- prepare personal balance sheets on a regular basis so that we know exactly what we own relative to what owe?

- prepare a budget at least annually, so that we may meet long-run financial goals, and track our spending against it?

- take the time to really understand the risks with our investments?

I consider financial literacy and the ability to make good decisions from it, a core life skill--like understanding and practicing good nutrition, but it’s skill that even some of the best educated in our country can neglect.

Financial illiteracy (and aliteracy) is sub-optimal, un-necessary, and can be addressed provided that there is a societal and personal commitment to reverse it. I believe that regular reading on topics like budgeting, taxes, investing, retirement planning, and the economy throughout our lives can by itself go a long way towards building and maintaining our financial literacy. But there are also many educational resources available for those motivated to learn--some of the most useful exist online, are interactive, and improve in quality all the time.

High school and community college courses on personal financial management have grown increasingly common. Although personal financial management has been traditionally thought of as a remedial topic of study, and as such has been absent from baccalaureate degree curriculums, perhaps now’s time to reconsider including it.

Even the federal government has become more involved with promoting it. In 2003, Congress created The Financial Literacy and Education Commission with the mandate “to improve financial literacy and education of persons in the United States.”

With a slowly growing economy, unemployment is now expected to remain high for years. Our national debt is expected to approach 100% of GDP by 2012 so income taxes for individuals are certain to increase even if government spending grows more slowly. Financial resources are seriously inadequate for an aging population. But, as a first line of defense, financial literacy and good financial management habits that begin early and remain robust throughout life will certainly improve upon these circumstances.

Saturday, March 13, 2010

Welcome!

Welcome to The Erudite Corner!

A place intended to share thoughts and ideas in

the spirit of the 17th and 18th century Age of

Enlightenment when scientific reasoning was applied

to human nature, society, and religion with emphasis

placed upon liberty, democracy, and happiness.

Celebration of the powers of reason was central to

this age.

A place intended to share thoughts and ideas in

the spirit of the 17th and 18th century Age of

Enlightenment when scientific reasoning was applied

to human nature, society, and religion with emphasis

placed upon liberty, democracy, and happiness.

Celebration of the powers of reason was central to

this age.

Subscribe to:

Comments (Atom)